Guide To: Buying a Vacation Rental

Are you interested in the short term rental real (STR) estate market? There is a lot to learn so you’ve come to the right place. Vacation rentals are very different to residential real estate in the goals, analysis, opportunity, and financing. This article details everything you should know when starting on your path to buy a short term rental.

As a management company for vacation rentals and as investors ourselves we’ve gone through this before and helped many buyers in selecting, analyzing, and managing their units. This article is a summary of all the lessons we’ve learned over the years.

“Owning a vacation rental property is not just an investment in real estate, it’s an investment in memories, experiences, and the opportunity to create a home away from home for your guests. The benefits of investing in a vacation rental property go far beyond financial gains, as it allows you to provide a unique and personalized experience for travelers while also creating a source of passive income for yourself.”

Where Should I Buy a Vacation Rental?

Deciding where to buy a vacation rental starts with understanding your goals, identifying attractive markets, and then weighing opportunity and risk. Short-term rentals have been successful in urban, suburban, remote, and rural markets however not all markets are made equal or will fit your needs. In our experience vacation markets and major downtown metro markets are the best performers. These are the markets that Lifty Life chooses to focus our buying and managing in.

Understanding your Goals

It’s easy to get excited about the idea of buying a vacation home. Who wouldn’t want a ski-in ski-out home on Whistler or an oceanfront cabin in Tofino but at some point you need to come back to reality and understand your goals and risk tolerance.

Before selecting the market you’ll need to ask yourself why am I buying this property? Here are some common reasons for buying a vacation rental or home:

Getaways – you want to use the property for your family, friend, and personal getaways and rent it short-term to help cover the cost of ownership.

Investment – the primary goal of buying a vacation property is as an investment.Personal Use* – this is your dream home. You may choose to never rent it or hardly ever. If you do it’s only for top dollar or to close friends and family.

I’m There All the Time – you often visit {destination} for work or visiting family and are purchasing a short term rental that can house you on these trips and be rented the rest of the time.

*This article focuses on buying a vacation home that will be rented part of full time.

Selecting a Market

The next question to ask yourself is “which region best fits my goals and budget?”

There are generally three types of markets that you can purchase a short-term rental in: metro markets, major vacation markets, and staycation markets. In many cases there is overlap on these categories, Kelowna for example falls in all three.

| Metro Markets | Major Vacation Markets | Staycation Markets | |

|---|---|---|---|

| Types of Guests |

|

|

|

| Example Markets |

|

|

Proximity to Where you Live

The close proximity of your short-term rental to where you live is less important than you might think. Sure there is a level of comfort in knowing you can be there in a couple hours but is that really necessary? Are you really the one that should be fixing a broken sink? Is it really worth your time to deliver the guest a roll of toilet paper? 99% of the time the answer is no.

In the majority of markets there are people that can help with the operational side of owning a vacation home. You can hire a cleaner, handyman, or even a full service management company like Lifty Life (shameless plug) to maintain your property, run the operations, and keep guests happy. These services minimize the risk of owning a distant vacation property.

Supply and Demand

Here is your economics 101 lesson: prices are highest in markets with high demand and low supply, prices are lowest in markets with low demand and high supply. The principles of supply and demand extend to both the real estate and the vacation rental world so it is something to really consider.

Take Tofino for example, the region is tiny, there are very few homes, and housing demand is huge. Unsurprisingly the real estate market there is hot and it’s even hotter for the select few buildings that are short-term rental friendly. The benefit of this region is because there is such a low supply of vacation rentals the average nightly rates are among the highest in the country.

Zoning & Bylaw Regulations

Before buying a property or setting your mind on a market you’ll need to understand the short term rental rules in that community. The restrictions on short term rentals are primarily on the municipal level in the form of zoning bylaws and business licensing. Check the municipal website in that community for clarification on the rules related to short term rentals. Don’t make the mistake of buying a home in a zoning that isn’t rental friendly.

Check out our Guide on the Airbnb Rules in BC

What Type of Vacation Rental Should I Buy?

This question mostly comes down to the numbers. What can you afford? How much will the property reasonably generate? What will it cost to operate and maintain the property? When considering what to buy consider the property type, number of bedrooms, amenities such as pools, hot tubs, laundry, and the kitchen.

To Strata or Not to Strata

Condos and townhomes are the most affordable property types and have a lot of great benefits beyond the sticker price but certainly can have some negatives. “Strata corporations” and “strata fees” are terrifying words for many investors. The idea of a group of tyrannical and incompetent Karen’s running the the strata council is the first thing that comes to mind for many. Fortunately vacation market strata’s tend to operate better than their suburban counterparts. The reason is the majority of owners are either investors or second home owners. The goals of these types of owners is to have the strata be run well, the bylaws to remain rental friendly, and the value of the real estate to be protected.

Strata fees will impact your profitability but they can offer a lot of value. Building maintenance, insurance, security, utilities, are all commonly covered expenses in your strata fees. Strata complexes can also have building amenities such as gyms, pools, hot tubs, secure parking, that can all be great for attracting travelers. However keep in mind, the more building amenities the higher your strata fees and higher the likelihood of a future levy.

Selecting a Niche: Luxury, Mid-Range, or Budget

Luxury Vacation Homes

The luxury segment of vacation rentals has the highest ceiling for earnings. Amazing properties in great locations can rent for $800+ per night. High-end furnishings, high-quality amenities, and a great guest experience are needed for this segment. Unsurprisingly these are also the most expensive properties to purchase, furnish, and set-up.

Harrison Hot Springs 3 bed home “The Overlook” managed since 2022

Mid-Range Vacation Homes

The mid-range segment of the market is the category that the majority of listings fall under. This is therefore the most crowded segment but stills remains attractive. Rates in this segment range between $150 to as much as $1,000 depending on the market. To stand out in this segment focus on providing a unique and eye-catching property and interior.

Ucluelet 2 bed home “Storm Bay” managed since 2020

Budget Vacation Homes

The budget segment can actually be a very attractive market in the short term rental industry. Properties in this market typically range in price from $50 to $250 a night. Depending on the property you choose to purchase you may be best suited to compete in providing superior value to budget and staycation travelers.

Harrison Hot Springs 1 bed “Harrison on the Lake” purchased in 2017

Amenities: Pools, Hot Tubs, and More

You may be wondering about the value that hot tubs, pools, and other major amenities add to the nightly rate of your property. There is no perfect calculation for this but here are some general estimates that should help. The impact of these amenities may instead impact your occupancy rate.

| Amenity | + Nightly Rate |

|---|---|

| Pool | $100 – $150 |

| Hot Tub | $30 – $40 |

| Laundry | $10 – $15 |

| Pet-Friendly | $25 – $50 / pet |

When providing major amenities such as pools or hot tubs you must consider the ongoing maintenance which can be very costly. If offering a pet-friendly space also consider the extra cleaning and risk of increased ware and tare.

Buying Furnished STR Real Estate

Often in vacation markets units are sold fully furnished. This can be a great benefit but not always. The reason that owners sell fully furnished is because the contents of the property are likely heavily rented and the cost to move the items is a hassle. For this reason contents are not valued when setting the asking price and shouldn’t be considered as part of your offer price.

Purchasing a furnished rental can lower the set-up costs and expediate the Go-Live time for getting it rented on Airbnb. However be prepared to replace items over time. When you get the keys do an audit of the entire property, replace items that need replacing, spruce up the space, and dispose of unwanted contents.

Canmore 2 bed townhome “Norquay” purchased in 2021

Left image – furnished Canmore rental purchased in 2020.

Right image – reflects small decor changes made to expediate Go-Live time.

Purchasing furnished lowered set-up expense and reduced the time to list.

How Much Will My Vacation Rental Make?

How much will this property make is probably the number one question I get asked at Lifty Life. Potential owners are looking for a property that at a minimum will cover its expenses or better yet profit! The truth is it’s hard to know. Each property is unique and market conditions are ever-changing. Plus most owners have a misunderstanding of the costs associated with operating a property. That being said there are a lot of tools and experience that the team at Lifty Life uses to make forecasts.

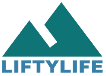

Understanding the Seasonality of the Market

Seasonality is a foreign word for long term rental owners but it is crucial to understand in the short term rental industry. Depending on your market you might actually lose money part of the year and need to make it all up in a short peak season. But even in four season markets you will notice that seasonality exists and will need to prepare and strategize for it.

Understanding the seasonality of your market might not be as easy as you think and many times potential buyers get it wrong. Take Canmore, Alberta for example; Canmore is the neighbouring community of Banff, Alberta and a fantastic rental market. The region has 4 ski resorts within an hour drive so potential buyers assume that the winter is an amazing season some even mistake it as the peak season.

However the reality it quite different. Summer in Banff and Canmore is undeniably peak season as shown in red on the calendar. Winter pails in comparison to the income that is earned within the Summer.

Why is this important? Because a misunderstanding of seasonality means you will have a misunderstanding of your cash flow and a misunderstanding of cashflow is a recipe for disaster. Understand the seasonality to manage your cash flow throughout the year and remember cash in the bank doesn’t necessarily mean you’ve profited.

Revenue Forecasting

To forecast your revenue the best tool on the market is Airdna. Simply provide the address, number of beds, baths, and guests to the Rentalizer tool.

Read our Airdna review here

Alternatively reach out to a local Airbnb manager to get their insights on the revenue potential of your property. Lifty Life for example provides revenue estimates for properties within our service regions.

Another amazing way to get revenue projections is to ask the owner for their financials (this assumes it is an STR).

Expense Forecasting

When forecasting your costs you’ll need to estimate your set-up costs, variable expenses, recurring expenses, and annual maintenance, The best way to forecast expenses is research. To do this grab some quotes from contractors, look for costs on MLS listings, and understand the fees of OTA sites.

1. Set-Up Costs

Among the set-up costs for your short-term rental are your down payment, closing costs, furnishing the property, stocking the unit with consumables, and adding smart home devices such as digital locks.

1. Down Payment & Closing – the down payment depends entirely on your financing strategy but 20% of purchase price is typical. We discuss financing options later in the article. You can estimate your closing cost with this tool.

2. Furnishing & Stocking – these expenses can vary widely but a good frame of reference is $5000 per bedroom to furnish the full home. Use our Short Term Rental Checklist to outfit your property and our stocking list.

2. Variable Fees & Expenses

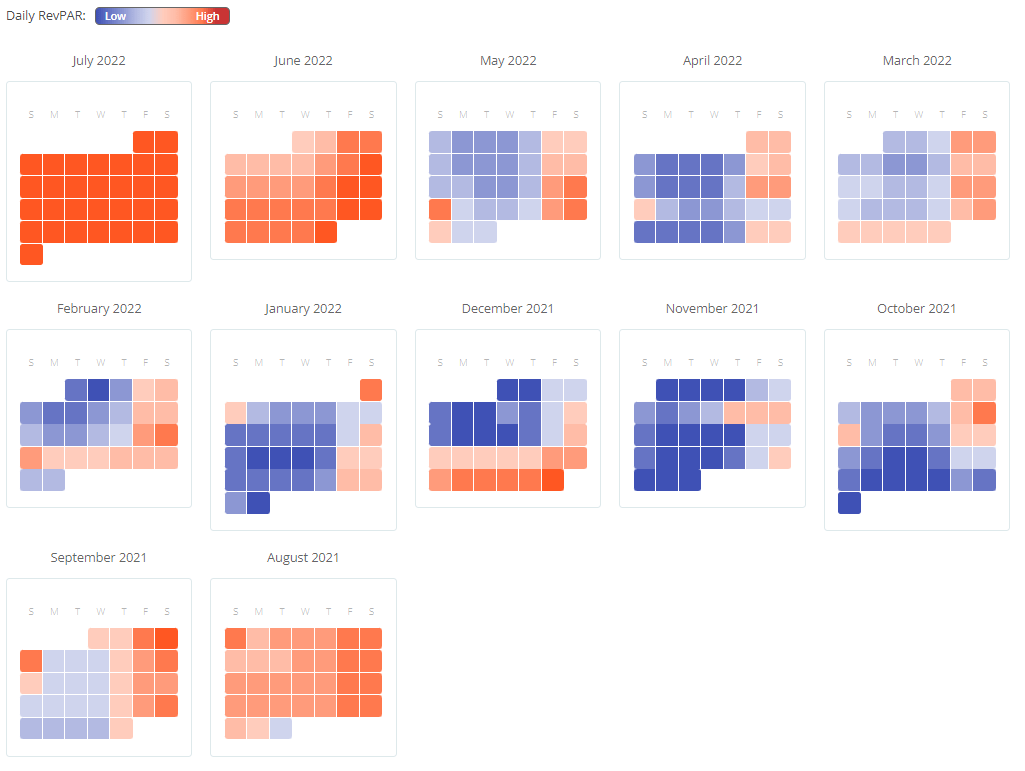

Variable expenses include the costs to clean and replenish between stays and the fees of Airbnb, VRBO, and other online travel agencies (OTAs). Depending on the sales channel you may also need to cover credit card processing. Taxes and management fees must also be considered when expense forecasting.

3. Cleaning & Replenishment – the cost to clean varies by region and property type. Get quotes from local cleaning companies to estimate this expense.

4. OTA & Credit Card Fees – OTAs fees include the charges made by sites like Airbnb and VRBO. Airbnb charges a 3% host fee and ~14% mark up to guests. VRBO charges a 5% host fee, 3% credit card processing, and 6-12% mark up.

5. Management Fees – hiring a manager or not you should forecast this cost. This allows you to value the work needed to manage the property. As a reference Lifty Life charges a 25% commission.

6. Taxes – will vary by province and municipality. GST, PST, and local tourism taxes are all applicable. Whistler for example the taxes are GST (5%), PST (8%), and MDRT (3%).

These diagrams demonstrate the fee structure of many property managers including Lifty Life. Lifty Life charges a 25% commission that is not inclusive of third-party fees like the fees of Airbnb or VRBO. In addition, Lifty Life charges a cleaning fee directly to the guest. As you can see the cleaning fee is a fixed rate and is, therefore, a larger portion of the reservation value on smaller bookings.

3. Recurring Expenses

Among your recurring expenses are anything that has a consistent monthly or annual cost. These expense include utilities, subscriptions, insurance, licensing, banking fees, financing, and strata fees.

7. Utilities – unlike with long term rentals, as the homeowner, you will be responsible for providing heat, water, electricity, and internet.

8. Subscriptions – this category includes subscriptions to streaming services (Netflix, Disney+), vacation rental software (channel manager, dynamic pricing), and business tools (G-suite, accounting software).

9. Insurance – STR insurance is different than your home or rental insurance; get a quote on STR insurance here. Not all providers insure short term rentals.

10. Licensing & Property Taxes – STR licensing can range from $100 to $2500 annually, depending on the city. Property taxes are disclosed on MLS listings.

11. Financing & Banking – use a mortgage calculator to get an estimate on your financing costs; here is the RBC calculator. Banking expenses include a credit card, chequing account, and e-transfer fees (used to pay cleaners).

12. Strata Fees – in stratified complexes you will also be responsible for strata fees. Check what is included in your strata fees in some cases utilities will be covered. You can find the monthly strata fee on the MLS.

4. Maintenance

A budget should be set aside for the general maintenance of your property, furnishings, and major amenities such as hot tubs and pools. In addition consider your landscaping and snow removal needs.

13. Handywork & Trades Work – it’s a matter of time till you will need some handy or trades work completed. My general rule is to set aside $2 per sqft a year.

14. Landscaping & Snow Removal – if you are not in a strata building someone will need to support you with landscaping and snow removal. Get quotes from local contractors.

15. Pools & Hot Tubs – pools cost on average $2,000 to $3,000 to maintain. Hot tubs cost about $700 to maintain. This assumes you do the work yourself, grab quotes from contractors in the area for a quote on their service.

How are Vacation Rentals Valued?

Now that you’ve narrowed your search to a property plus forecasted revenue and expenses, how do you value the real estate?

Short term rentals and vacation rentals are still typically valued in the same way as residential real estate. This means that commercial and multi-family real estate metrics such as capitalization (cap) rates aren’t regularly used to value short term rentals. Market comparables and qualitative criteria are the more commonly used to determine asking and offer prices.

Capitalization (Cap) Rates

Cap rates are a common metric used in real estate investing to calculate the value of an asset. Cap rates are a great tool to identify real estate opportunities. Use this Cap Rate Calculator to evaluate the opportunity of your property.

In the long term rental industry a 4 – 12% cap rate is considered good. However what makes a good cap rate varies depending on the market and property type.

Whistler studio condo “The Après” purchased in 2014

| Property Value | $185,000 |

|---|---|

| Gross Income | $52,000 |

| Operating | 35% |

| Vacancy | 21% |

| Net Income | $26,702 |

| Cap Rate | 14.43% |

Pro Tip: calculate if the property would be profitable as a long term rental. As Covid has proven the income of short term rentals is not guaranteed. Have a back up plan in case of the unexpected. Be conservative in your estimates, don’t overleverage, or carry unmanageable risk.

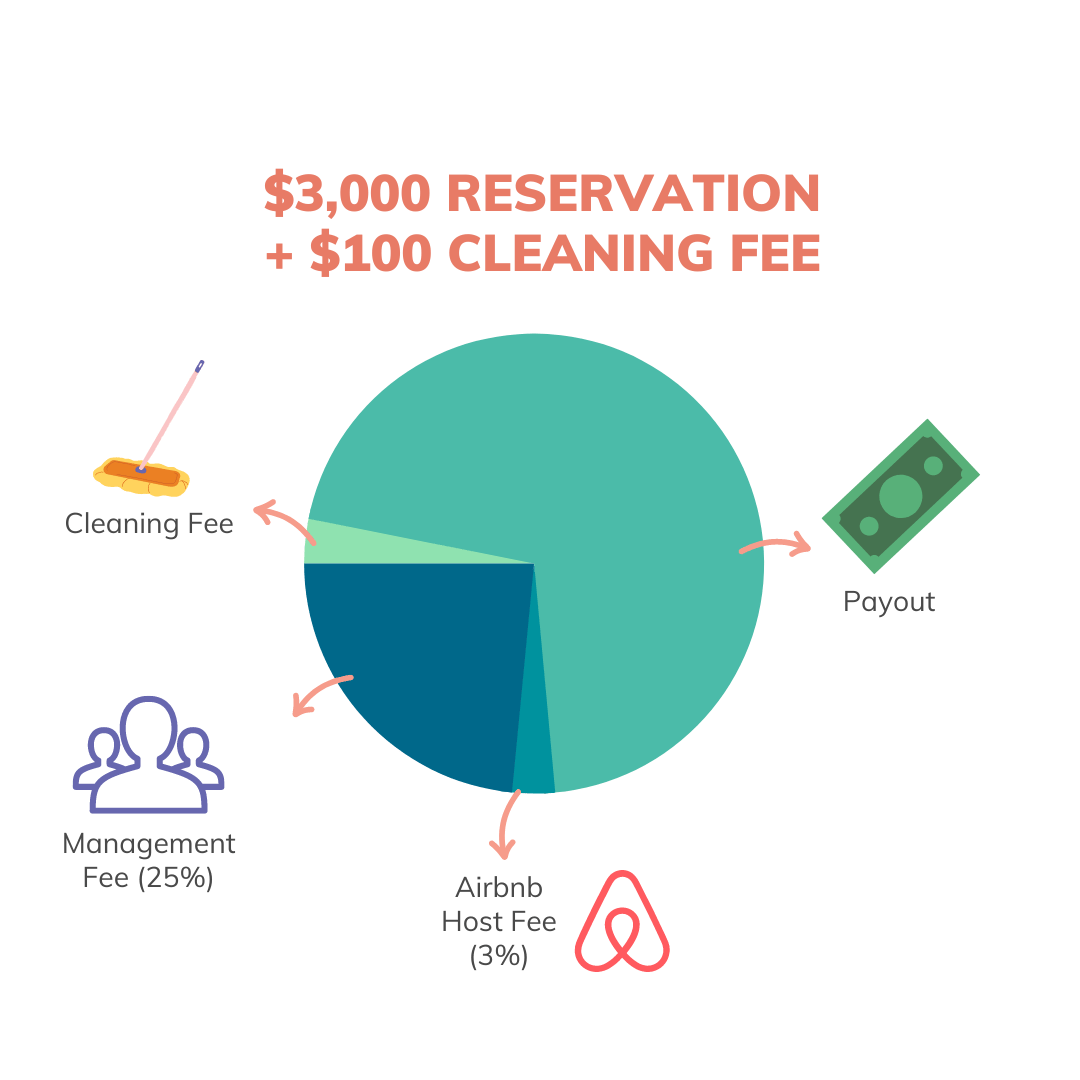

Market Comparables

Short-term rental real estate is determined primarily by market comparables (comps). Comps are properties that are for sale or have sold that are similar and in the same market. To determine what real estate market comparables to use I’ve compiled a list of quantitative and qualitative criteria to use.

Real Estate Comps Criteria:

- Square footage (sqft) or square meters (m²)

- Number of bedrooms and bathrooms

- Age of building

- Zoning

- Building amenities (pools, hot tubs, etc)

In most cases you will not find exact matches. Work to create a comp set as similar as possible. In doing so you’ll be able to better identify undervalued or overvalued short-term rental properties.

In addition to creating a market comp for the real estate; you may also want to create a comp of Airbnb listings. Here are some additional criteria to use when creating a comp set for the Airbnb potential.

Airbnb Listings Comps Criteria

- Everything from “Real Estate Comps Criteria”

- Furnishings & finishing’s

- Number of reviews and review score

- Average nightly rate and occupancy

- Number of beds and maximum occupancy

Tools like Airdna’s Rentalizer, example shown below, can also be helpful in quickly identifying an Airbnb comp set.

Qualitative Criteria

There are things to value and consider outside of the numbers. Lifty Life for example has market selection criteria that includes things like brand fit and a coolness factor that is unique to our business.

On the individual investor perspective you should consider how much you or your family will use the property. How well does the lifestyle of the market fit with your own? Does the design and finishing’s of the property fit with your own sense of design? Will you love owning this property? Will this space provide an amazing guest experience?

Opportunity Costs & Risk

The final thing to consider when evaluating real estate is to consider the opportunity cost and risk. Does purchasing this property stretch you to aggressively? Would you have a better return on your investment elsewhere? Would it be better to wait till you are in a stronger financial position? Are you fully aware of the risks associated with short term rental investing?

How can I Finance a Vacation Rental?

The main ways that short term rentals are financed are through a mortgage from a smaller bank, using a HELOC, and/or pooling resources together through a joint venture. Other financing options that may also be possible is owner financing and commercial lending.

Mortgages

Mortgages are the most the common way to finance vacation rentals especially for first investment properties. However many major banks such as RBC will not finance short term rentals. The best thing to do is approach a mortgage brokers to get assistance in finding a suitable lender for the property you are interested in. Smaller banks often have more relaxed lending criteria and may be more able to help you.

The other restriction to mortgages can often be the zoning and/or title type. Lots of great properties may be difficult or impossible because of the title. Leaseholds and co-ops are both ownership types that can be difficult to finance with a mortgage.

Home Equity Line of Credit

If you already own a home you may have a great source of financing available to you through your Home Equity Line of Credit (HELOC). HELOCs are an amazing financial instrument because of their relatively easy lending restrictions and flexibility.

With a HELOC you can access the equity of your home, up to 85%. Many short term rentals are purchased with the use of a HELOC on a primary residency. Subsequently many second or third investments are financed from HELOC of the first short term rental investment.

For example since purchasing my first STR in Whistler in 2014 I’ve used years of appreciation to refinance, with a HELOC, and purchase subsequent properties in Canmore and Calgary, Alberta. After closing with the use of a HELOC, I returned to the bank the next day, and converted the HELOC into a mortgage at a lower interest rate.

Calgary 2 bed townhome “The Spruce” purchased in 2022

Joint Ventures

Finding investment partners is a fantastic way to access additional capital, lending capacity, and experience. Joint ventures can also mitigate risk by spreading it among more people and forces you to make more calculated decisions that are less influenced by emotion.

Make sure the partner has the same goals as you. If this is a purely an investment all parties should be on board with that. It will cause conflict if one partner is planning on using peak rental dates for personal use and the other wants to maximize earnings by renting the peak season full-time. The best way to resolve these conflicts is to be on the same page from the beginning and to stay in communication about each others plans. You may realize over time your goals may have changed and your expectations departed.

In addition to understanding each others goals make sure to outline each parties responsibilities. Who is gonna be responsible to manage reservations? Who will be managing the cleaning and maintenance of the vacation home? How will the income of the property be split? Who will be on title? Make things are crystal clear from the beginning and consider signing a contract.

Where can I find a Knowledgeable STR Realtor?

If you’ve identified some attractive markets, gained an understanding of the opportunity and your financing you are probably ready to reach out to a realtor. But how can you identity a quality realtor with an in-depth knowledge of the short term rental market? It’s not easy because nearly every realtor will say they are experts. We’ve compiled a list of questions to ask realtors to help vet them.

Questions to Ask Realtors

- Do you own a short-term rental yourself? Have you in the past?

- How regularly do you help short-term rental investors?

- What are the restrictions on short-term rentals in your market?

- How has the market been for short-term rentals been?

- What are the short-term rental restrictions in {building}?

- Can you recommend a reputable STR management company?

A good strategy to vet a realtor is to already have the answer to question 3.

Realtor Referrals

Among the best strategies to find reputable and qualified realtors is to find recommendations from Airbnb hosts or vacation rental managers.

Lifty Life has a network of realtors which we refer and use personally. We are always happy to recommend our network.

How to Manage Existing Reservations

If you are buying an existing short term rental that has future reservations, you may be wondering what to do with the bookings. There are four options to consider but before making a choice you should first do a little analysis.

- Are the reservations booked at a rate that you feel comfortable honouring? Many owners underprice their units because they manage part-time and/or rely on the Airbnb Smart Pricing algorithm.

- Are the Airbnb and VRBO accounts SuperHost and/or Premier Host? How are the reviews?

- Does the property have immediate maintenance or renovation needs that you’d like to address?

- Do some of the booked dates conflict with dates you’d like to use the property personally?

Once you’ve answered if the reservations are worth keeping and whether or not the accounts are in good standing you can consider one of four strategies to deal with existing reservations.

1. Taking Over Accounts

The first option to consider is taking over the Airbnb and VRBO accounts of the previous owner. This is only sensible if the accounts have lots of high-quality reviews and/or are SuperHost/Premier Host. I recommend against this option but many buyers choose to go down this route since it can provide a lot of value and creditability.

2. Rebooking Guests onto your Accounts

Assuming the reservations have been booked at reasonable rates and the dates work for your needs the best option is to rebook guests onto your own account. This is Lifty Life’s preferred strategy because it keeps guests happy, guarantees income, and builds up the review base on your personal accounts.

3. Canceling Reservations

If for whatever reason you don’t want to honour the existing reservations; having the current owner cancel reservations is the best option. You have no obligation to honour any booking made by the current owner or by their management company. This strategy is likely to be the most contentious between buyer, seller, and perhaps management company.

Canceling bookings is the simplest strategy on your end. The only thing you’ll need to do is alert the seller that you won’t be honouring existing reservations. It will be on the owner to cancel reservations with guests, provide refunds, and deal with the consequences. The one step you should take to minimize risk is to replace the door codes and/or locks.

4. Keeping them as a Cohost

The final and least common strategy is to contract the current owner as a cohost or property manager. This strategy is only sensible if the seller has been a strong operator that you believe will continue to provide a great service. Ask the seller about this option. If they are interested consider signing a contract, determine the revenue split, and get yourself cohosted on the listings. This is a great strategy for a passive investor.

Alternatively if the current owner is using a vacation rental manager consider contracting with that management organization to continue managing your unit.

Should I Hire a Vacation Rental Management Company?

A property manager is a great option if you are investing into short term rentals. With a manager there is no need to take the 4am calls from guests, no need to worry about cleaning, no need to stress about toilet paper, or the hundred other issues that arise when operating a vacation home. For investors looking to remain more passive a short term rental manager is a welcome investment. A good manager will more than make up for their expense by freeing up your time, protecting your asset, and out-preforming the market.

If you are interested in learning about Lifty Life’s service use the below buttons:

Ucluelet lofted condo “Fern Gully” managed since 2021

Manning Park 4 bed cabin “Whisky Jack” managed since 2022